Would there be anything higher than a god? Only the devil knows.

GMT 0 Accra, Ghana

The world is not flat. The world is not round. The world appears flat yet extends like an inflating orb, and I am an ephemeral traveler on its paths. I am far from a full load of worthy souvenirs but I will not make haste. For I am a traveler bounded by a perpetual realm not of this world, not for myself. I am eternal, and I will be home soon.

Would there be anything higher than a god? Only the devil knows.

GMT 0 Accra, Ghana

It has been over a month. Lots of things had happened. Lots of thoughts and ideas that failed to come into writing. The day I left Brasil I know that my blogging endeavor has entered a hiatus.

hi·a·tus

n. pl. hi·a·tus·es or hiatus

A gap or interruption in space, time, or continuity; a break (http://www.thefreedictionary.com)

The word seems hifalutin; maybe because most of the Latin words or phrases adopted verbatim by the English language have this sort of grandeur as with their former empire. I even have to "google" it when I first encountered the term in the height of my TV series following (yes, an episode is ready for download the night it aired). Then I became less fond of the word ever since; at least the meaning it applies to my engrossing TV series – having to wait for a month after a cliffhanging episode of Smallville or Heroes! US TV stations usually implement a hiatus for their programs for the sheer purpose of running it longer or to make avid audiences hooked to future episodes/seasons or it's way of evaluating ratings before totally cancelling the show.

Well, hiatus is not bad when in the context of corporate slavery; actually it is in the same pedestal with that of annual bonus and Christmas party. Sometimes, unfortunately, it is next to impossible.

All of us will definitely undergo hiatuses in our lives. We even have hiatuses in our daily lives. They can be forced or they can be planned. They can be desirable or they can be disastrous. It all depends on how we go through with our lives. Of course, everyone needs to have hiatus from the things they are tired of doing because they are simply tired. But then, hiatus from the things they love doing is a different story. There might be some valid reasons. Of course why would I want to stop when I am enjoying. I don't think I can even have that thought in the middle of it all. Yet somehow the universe has its ways of conspiring with itself; an unexpected force that will slow me down to a full stop.

And then, hiatus.

I now understand that this is a natural human cycle; a part of God's grand design. It gives me a chance to re-evaluate life. If the hiatus is due to exhaustion then I might consider doing different things. If the hiatus, on the other hand, just gives me a reason to continue on, then I live the old life yet another day. And then I just realised that a hiatus may also open doors to new things aside from those that I love. Not most people can juggle all balls with one hand so the hiatus becomes a turning point, a crossroad. One thing is certain: no wrong choices; only opportunities. Afterall, we have a lot of hiatuses to last a lifetime.

My archive will definitely regret the fact that November 2008 will never be part of its index. But I don't regret the hiatus that just passed.

It just made me continue writing.

GMT 0 Accra, Ghana

SLEX. South Luzon EXpressway. This major Philippine thoroughfare, which connects CALABARZON to Imperial Manila, has been and always be part of my life. Why not? As a kid growing in a province, I look forward going to the 'big city' whenever my family goes for Christmas shopping or to experience the things only the city can offer. After high school, I can't wait to take that first bus heading to my dream of higher learning. You see, most Filipinos have this notion that studying in one of the colleges/universities in Manila gives one a certain prestige back home. Not to mention being enrolled in those well-known institutions with their pride colors, animal mascots and basketball teams. And going to the city means traversing SLEX. So the recent editorial cartoon in the Inquirer didn't have a hard time getting my attention. I'm aware of the ongoing SLEX upgrading and rehabilitation project since May 2006, and I well remember the stressful bus rides due to these stone control devices/barricades that re-route traffic in a haphazard fashion. The usual one-and-a-half-hour San Pablo-Manila trip becomes a two- to three-hour butt torture. I bet the 1956 Ten Commandments or The Sound of Music or Titanic can be played on-board JAC Liner from the start and be able to finish it. But the cartoon depicts it a bit creepy: Death welcoming motorists to an unwelcoming SLEX; at least the coniferous trees are still there amidst the morbidness. This might be due to the hazardous nature of the recent construction works and the increasing probability of a vehicular accident. The editorial cartoon might want to tell those people involved that they are not doing a satisfactory job specially in traffic flow management and safety. Well, I already told myself that sooner or later the ongoing project will be messy since SLEX is always expecting a huge volume of motorists (CALABARZON, afterall, is on the rise). An irritated and exhausted driver sometimes looses sound road decision-making. Anyway, they say the project is set to finish by March 2009 and, like in the NLEX (it's northern counterpart rehabilitated by 2005), the temporary nuisance is a trade off to a much modernized highway. Just expect higher toll fees though. Haha! From one nuisance to another. Welcome to the Philippines!

SLEX. South Luzon EXpressway. This major Philippine thoroughfare, which connects CALABARZON to Imperial Manila, has been and always be part of my life. Why not? As a kid growing in a province, I look forward going to the 'big city' whenever my family goes for Christmas shopping or to experience the things only the city can offer. After high school, I can't wait to take that first bus heading to my dream of higher learning. You see, most Filipinos have this notion that studying in one of the colleges/universities in Manila gives one a certain prestige back home. Not to mention being enrolled in those well-known institutions with their pride colors, animal mascots and basketball teams. And going to the city means traversing SLEX. So the recent editorial cartoon in the Inquirer didn't have a hard time getting my attention. I'm aware of the ongoing SLEX upgrading and rehabilitation project since May 2006, and I well remember the stressful bus rides due to these stone control devices/barricades that re-route traffic in a haphazard fashion. The usual one-and-a-half-hour San Pablo-Manila trip becomes a two- to three-hour butt torture. I bet the 1956 Ten Commandments or The Sound of Music or Titanic can be played on-board JAC Liner from the start and be able to finish it. But the cartoon depicts it a bit creepy: Death welcoming motorists to an unwelcoming SLEX; at least the coniferous trees are still there amidst the morbidness. This might be due to the hazardous nature of the recent construction works and the increasing probability of a vehicular accident. The editorial cartoon might want to tell those people involved that they are not doing a satisfactory job specially in traffic flow management and safety. Well, I already told myself that sooner or later the ongoing project will be messy since SLEX is always expecting a huge volume of motorists (CALABARZON, afterall, is on the rise). An irritated and exhausted driver sometimes looses sound road decision-making. Anyway, they say the project is set to finish by March 2009 and, like in the NLEX (it's northern counterpart rehabilitated by 2005), the temporary nuisance is a trade off to a much modernized highway. Just expect higher toll fees though. Haha! From one nuisance to another. Welcome to the Philippines! The ominous caricature is far from the nostalgic picture in my mind. I still want to imagine SLEX with its tree-lined highway, the Mt. Makiling from the distant southern end and the rice field on either side that boasts of its lushness and of the fresh air waiting to be inhaled. This picture will stay even with the rice fields being bulldozed to make way for future subdivisions. It will stay. At least a fantasy of one who used to be a probinsyano (a Pinoy word concoction of "someone from the province") kid who takes joy traversing the SLEX en route the big city. At least a comforting bus ride of one who used to be a student then a professional working in the city en route a place for the weekend respite. And as I outgrow that childhood fantasy, traversing SLEX seems to reduce to traversing a one-way path – a direction that shall only lead me beyond the greens and blues of Mt. Makiling – back home. Yes, I had a change of heart. If after graduating high school I planned of getting the best education, build a successful career and then settling in Manila, today it remains the same but not the place to settle. If my adolescent impulse is to leave that place I consider lame and boring, now I like to go back and redefine those words: simple and quiet. I guess the smog and congestion succeeded in diminishing the value of being a Manileño on a personal level. Besides there are lots of Pinoys who are still city bound. I might as well be one less of that count. I don't hate Manila, don't get me wrong. I still love going to the malls and other places of interest (haven't been in Intramuros actually). But if I were to fulfill one of the things in my bucket list – that is, having a house overlooking Mother Nature at one of her glories (see the full list on the side frame) – I love it to be back in my hometown. I don't mind being far from the political, economic and cultural capital; I'll build my own version in San Pablo. The plans, however, may still change. Anything can happen in the next years specially now that working means traveling. I might end up somewhere else but I bet it would be due mainly to the future Mrs. Brosas. But for now, I would love to turn right to that exit at the far south end where the coconuts grow.

The ominous caricature is far from the nostalgic picture in my mind. I still want to imagine SLEX with its tree-lined highway, the Mt. Makiling from the distant southern end and the rice field on either side that boasts of its lushness and of the fresh air waiting to be inhaled. This picture will stay even with the rice fields being bulldozed to make way for future subdivisions. It will stay. At least a fantasy of one who used to be a probinsyano (a Pinoy word concoction of "someone from the province") kid who takes joy traversing the SLEX en route the big city. At least a comforting bus ride of one who used to be a student then a professional working in the city en route a place for the weekend respite. And as I outgrow that childhood fantasy, traversing SLEX seems to reduce to traversing a one-way path – a direction that shall only lead me beyond the greens and blues of Mt. Makiling – back home. Yes, I had a change of heart. If after graduating high school I planned of getting the best education, build a successful career and then settling in Manila, today it remains the same but not the place to settle. If my adolescent impulse is to leave that place I consider lame and boring, now I like to go back and redefine those words: simple and quiet. I guess the smog and congestion succeeded in diminishing the value of being a Manileño on a personal level. Besides there are lots of Pinoys who are still city bound. I might as well be one less of that count. I don't hate Manila, don't get me wrong. I still love going to the malls and other places of interest (haven't been in Intramuros actually). But if I were to fulfill one of the things in my bucket list – that is, having a house overlooking Mother Nature at one of her glories (see the full list on the side frame) – I love it to be back in my hometown. I don't mind being far from the political, economic and cultural capital; I'll build my own version in San Pablo. The plans, however, may still change. Anything can happen in the next years specially now that working means traveling. I might end up somewhere else but I bet it would be due mainly to the future Mrs. Brosas. But for now, I would love to turn right to that exit at the far south end where the coconuts grow.

Ergo the end of modern civilization, if not end of the world.

Though debatable, I think global bankruptcy is a far-fetched scenario – if it really does happen civilization will just go on a re-boot; the world starting on a clean slate. Money, afterall, is just human invention. It's just like Filipino children of the 90's (yes, emphasis is needed here) playing habulan from dusk until full moon's high unanimously declaring a game over if they feel that no one's enjoying anymore. It would just take a unanimous vote of the UN General Assembly or, maybe, just the mere handshakes of the Group of Eight to declare a Jubilee Year like in Moses' Laws; all debts wiped out on the face of the earth! The only difference is Moses' Jubilee Year was mandated due to heavenly command whereas the latter is an escape from man's fall due to greed.

Yes, greed. It is the inevitable consequence of this human creation, money. Gone were the days where people works together, tills together and reaps together then festivities together afterwards; where all the harvests are communal and no one owes anyone. A scenario which, I think, existed when early homo sapiens walk the earth as nomads. As soon as people started to get settled, businesses commenced operations and the evolution of human avarice is history. It's paradoxically funny to think that the rise and advancement of human species aimed at life's simplicity come with such complexity.

And the recent global economic crisis serves as a reminder of how fragile and volatile this societal pillar we call financial institutions. For a common Juan de la Cruz such as myself, all the details of the recent events seem like Greek. All I know is just 'big-time' companies are either closing down or being bought or bailed-out with such names as Bear Stearns, IndyMac, Lehman Brothers, Merrill Lynch and AIG flashing over the headlines. A person immersed in technical engineering terms suddenly becomes interested in terminologies such as mortgage, credit crunch, subprime, recession, inflation and economic bubble – at least I find a somewhat kiddy comfort on the bubble thing. What interests me most is the idea of derivatives (ok, lower the geek-meter for this is not calculus). Apparently, financial world is as much complicated as our politics back home. Imagine investing on something that is said to have a value highly dependent on another which has obtained its value from a third entity which may have been invested on a fourth. Think of the multi-level marketing (MLM) scheme still prevalent in the Philippines. The top layer rakes in most of the profit, the ones in the middle get parts of the chunk and the lower layer, well, stays there. I'm not into these things so any 'financial gurus' feel free to correct me. But the basic idea is the volatility of it all. Imagine one card falls off the rest of the deck. And I think that what has happened on Wall Street a month ago. I read somewhere that it has its roots many years back though. Nevertheless, it may well boils down to the basic truth, that these companies, wanting to earn more, took risk investing on greed.

Picture this:

Pedro: Hey Juan, Mario borrowed some marbles from me.

Juan: But he owes most of the kids here, do you think he'll pay it back?

Pedro: Don't worry he will. He just needed extra marbles for the game on the next block. Besides, I told him that I'll lend him if he agrees to pay me five-folds.

Juan : Whoa! That's a lot of marbles added to your collection.

Pedro : Yeah. So, do you want to have a share on that? All you need to do is pool some of your marbles to me so we can lend Tomas with the same terms. We'll split the additional marbles 50/50.

Juan : I'm in!

Then Juan did the same with Berto but the split is 60/40 from the 50% of the first agreement. Berto, who's also fond of trading cards, offered a similar scheme with Orli, a marble enthusiast: trade some of Orli's card collection for 40% of the marbles Berto can get from the previous agreement. Well, Orli wants to have more marbles so I guess he will look for a kid in the neighborhood to get a similar agreement as with the others. And you'll picture the rest of the story; no offense intended to children.

There you go. The gist of what had led to the current crisis in my personal understanding. They call it the US subprime mortgage crisis. Well, there are other factors that involves the government and other sectors of the society albeit too Greek, nay, alien to people like me. What stands out is that these Wallstreet biggies enjoyed quasi-autonomous run of the financial world; a seemingly exclusive club for those in black suits and top hats. Capitalists, afterall, are born to profit at any cost and this costs us big time! The world economy is now on a slowdown (Iceland is on the brink of bankruptcy!). I don't want this blog to be a sort of attack to this financial institutions. Afterall, they are just doing their job no matter how greedy they appear to me and now they are suffering the consequences of their short-sightedness. And so are we, thank you very much!

I bet the financial world will never be the same again with all the impending reforms and legislation to avoid the same fate as today. Wallstreet, in particular, will loose all its perks as a deregulated entity. Economies will not be seen as a Monopoly gameboard for a while. This period will be remembered and shall be written down on textbooks as lessons to be learned in Economic schools added to that of the Great Depression of the 30's and the Asian Financial Crisis of 1997.

I will never be the same again.

So this leads me to the microcosm of this global incident: my own avarice.

I admit I'm a materialistic person. I get this impulsive drive to buy things that I fancy. If I have the money, I'll buy it. If not, then what do my 3 credit cards doing in my wallet. Don't ask the credit limits! They say don't trust a woman with your credit card. I say, don't trust myself with my credit card. It's not all about women and their inherent love for shopping (ok, feminists feel free to attack me). It's not all about having multiple credit cards in the pocket regardless of gender. Borrowing money is not an evil thing (unless one intends to run away with it). More so, money is not evil. What's wrong is my immoderate desire, nay, lust for material things. And worst, I tend to borrow money through credit cards just to satisfy this. I remember having to owe the card company which I begun to find hard to pay. Sometimes I thought that I was just paying for the finance charge. You see, that was my problem before. I thought having credit card gives one much needed purchasing power. No worries, I can pay it anyway on the end of the month. But I fail to realize that it was a psychological warfare; having to give a self-perception that I am rich, it is also self-destructive.

So you see, I don't need to criticize and attack those companies for their greedy actions. Let authortities and experts deal with that. It's their world. I have my own world (no, I'm not autistic). Let them have their reforms, and I will have my own. Ironically, now that I'm earning more than before I become frugal with my finances; planning towards investments rather than liable expenses. No more to purchases where payment is drawn on credit. No more to purchases that exceed my income. I'll keep the credit cards though. It's still good to maintain a credit line. But I'll just use it for cashless purchases (no, this is different from credit purchases; instead of withdrawing cash, I'll pay through card and just pay in full online the same day). At least I'll earn more redeemable points (maybe donate these points to Children's Hour). At least it will be robber-proof!

I'll be buying a Nikon D90 and iPhone 3G when I come home this year. It will be my last liable swanky purchases (maybe for the next 2 years) then the rest of my savings will go to investments. But I'll be paying these with my credit cards. Only this time I'm sure I can afford them.

This time I know, personally and financially, I am far from being bankrupt.

GMT -3 Sao Paulo, Brazil

Waiting. Marshmallow Test. Seems like two things on each end of the spectrum. But who says impromptu conversations are random? Interestingly enough, this psychological test by Walter Mischel four decades ago is all about waiting: four-year olds being given a marshmallow and promised another, only if they could wait 20 minutes before eating the first one. Some children could wait and others could not. And, as reported, those who waited became successful later in life. Could have I passed the test? Well, I consider myself nearing success but why does it make me think otherwise? Maybe because I'm yet to be halfway on my journey. Maybe because until now I'm haunted by that test lurking behind me. Maybe because I'm yet to respond on my own marshmallow. Darn! My pre-school teacher should have given me the test already.

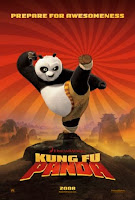

Waiting. Marshmallow Test. Seems like two things on each end of the spectrum. But who says impromptu conversations are random? Interestingly enough, this psychological test by Walter Mischel four decades ago is all about waiting: four-year olds being given a marshmallow and promised another, only if they could wait 20 minutes before eating the first one. Some children could wait and others could not. And, as reported, those who waited became successful later in life. Could have I passed the test? Well, I consider myself nearing success but why does it make me think otherwise? Maybe because I'm yet to be halfway on my journey. Maybe because until now I'm haunted by that test lurking behind me. Maybe because I'm yet to respond on my own marshmallow. Darn! My pre-school teacher should have given me the test already. downloadables; essential of which are movies – sometimes cable TV does not give me the pleasure of preferable programming, you know. Thanks to BitComet I had Kung Fu Panda tickle my funny bones today. No, actually, I think it cracked it. That would be better than a happy thought for today. It’s the funniest animation I’ve seen since Shrek. The kind that makes you laugh out loud. Feels good and makes an effective cure to idle sickness. But what makes it “blog-worthy” is the fact that alongside all the laughs and fist-banging on the coffee table realizations made their way to my core, yet again. I don’t want to be a spoiler but on a gist the movie is all about an important lesson in life. Faith in oneself. Yes, a formulaic theme of numerous books, movies, talks and the like but it’s a theme needed to be repeated over and over again so as to permanently assimilate it to our way of life. And as human beings, we tend to linger too much on the past and be anxious of what lies ahead. Like Master Oogway said to an apprehensive Master Shifu on training the would-be Dragon Master, Po:

downloadables; essential of which are movies – sometimes cable TV does not give me the pleasure of preferable programming, you know. Thanks to BitComet I had Kung Fu Panda tickle my funny bones today. No, actually, I think it cracked it. That would be better than a happy thought for today. It’s the funniest animation I’ve seen since Shrek. The kind that makes you laugh out loud. Feels good and makes an effective cure to idle sickness. But what makes it “blog-worthy” is the fact that alongside all the laughs and fist-banging on the coffee table realizations made their way to my core, yet again. I don’t want to be a spoiler but on a gist the movie is all about an important lesson in life. Faith in oneself. Yes, a formulaic theme of numerous books, movies, talks and the like but it’s a theme needed to be repeated over and over again so as to permanently assimilate it to our way of life. And as human beings, we tend to linger too much on the past and be anxious of what lies ahead. Like Master Oogway said to an apprehensive Master Shifu on training the would-be Dragon Master, Po: And I just did. Again. One idle day seems to be worthwhile and it will come to pass before you know it. With tortang talong (it was my first time and I thank Kuya Marky for showing me how when we were in Georgia) and strips of bacon matching red wine, there is no secret ingredient for a sumptuous end-of-the-day meal. Who would have thought it could be a nice dinner combination? Well, it could have been attributed to the fact that there were almost nothing left inside the fridge from last grocery. Nonetheless, it established the idea that it is survival instinct to ultimately rely on oneself. No secret ingredient. No secret recipe of some sort. Just me cooking and enjoying the meal afterwards.

And I just did. Again. One idle day seems to be worthwhile and it will come to pass before you know it. With tortang talong (it was my first time and I thank Kuya Marky for showing me how when we were in Georgia) and strips of bacon matching red wine, there is no secret ingredient for a sumptuous end-of-the-day meal. Who would have thought it could be a nice dinner combination? Well, it could have been attributed to the fact that there were almost nothing left inside the fridge from last grocery. Nonetheless, it established the idea that it is survival instinct to ultimately rely on oneself. No secret ingredient. No secret recipe of some sort. Just me cooking and enjoying the meal afterwards.